Well we knew that the supply chain bullwhip was coming. It was inevitable. Over ordering combined with massive disruptions and bottlenecks severely warped supply chains globally. The initial result was at first under supply, but now that the bottlenecks are mostly gone the massive over ordering is coming home to roost. Inventory levels have skyrocketed (no wonder the industrial real estate market is on fire) because goods finally made it to the US in 1H 2022 at the same time demand for goods is now falling. (Everyone bought so much during Covid that they just don’t need anymore furniture, appliances, gym equipment, etc). As a side note, my mom bought 6 new couches during Covid. Don’t ask.

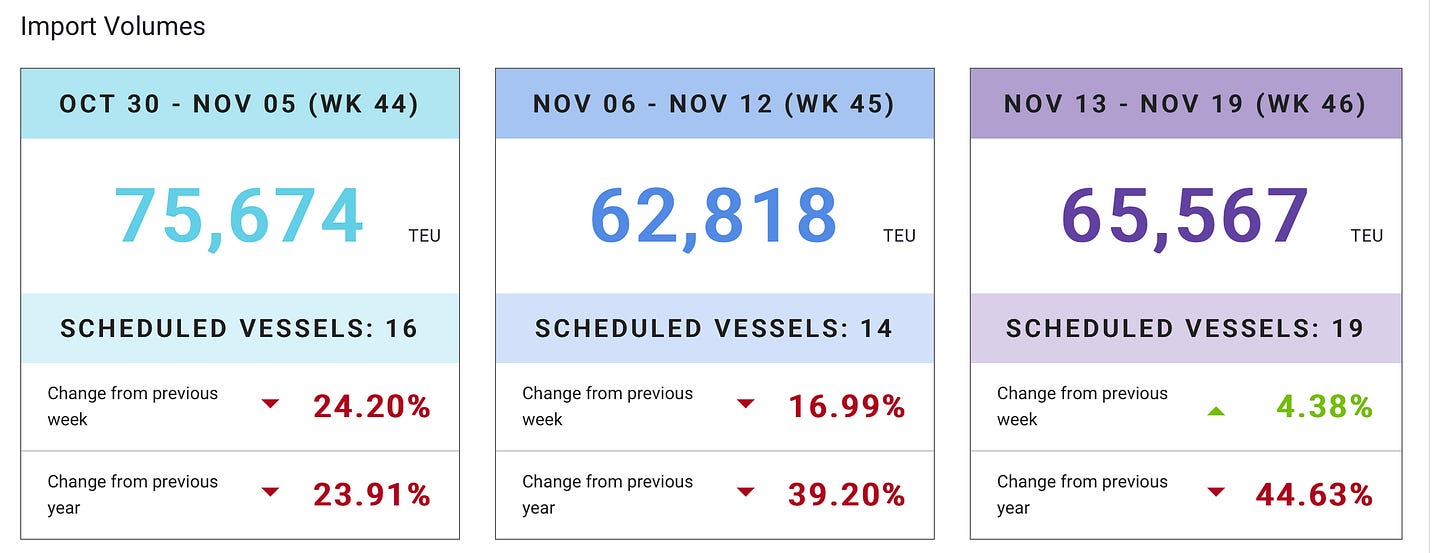

So what’s next? Massive fall off in import volumes (because that’s where we get most of our physical goods). Which is exactly what we’re seeing at the west coast ports. (And right now is supposed to be peak season). The line of backed up ships that once reach 109 is now down to 2 this past week. Worse still the volume of containers on these ships is plummeting YOY. Here’s the schedule container deliveries at LA ports. Down -23% this week, -39% next week, and -44% next week. This is bad , not a little, very bad.

So what will happen because of the steep fall in imports:

Initially this will be positive for GDP as net exports will actually go up (lower imports with flat or rising exports results in higher net export GDP contribution). We just saw in Q3 that net exports contributed a 2.7% of GDP (a record since the early 80s).

Continued declines in the shipping and trucking industries. Including layoffs, bankruptcies, etc.

Reduced trucking will impact demand for diesel. Perhaps the diesel inventory crisis we’ve been hearing about is more a function of refineries preparing for reduced demand???

Declines and layoffs in the warehousing, wholesaling, and retail sectors. Clearly they’re all cutting orders because of sales issues.

Price reductions in these industries to move inventory and generate cash. Full warehouses are a bid sign when sales are falling.

Eventually this will impact industrial real estate leasing and property values which are in a massive bubble right now.

Now to hedge my forecast, I will admit that 3 data points now matter how bad they are do not necessarily make a trend, but we will know for sure how bad imports are going to be by Christmas.